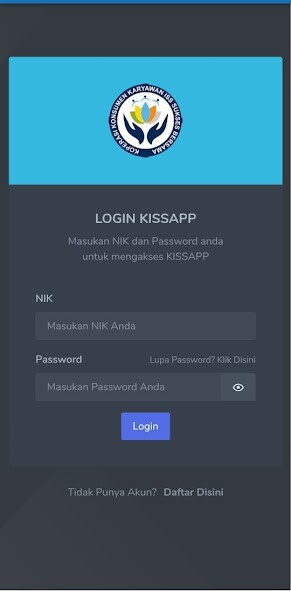

We provide KissApp Official online (apkid: com.kissmobile) in order to run this application in our online Android emulator.

Description:

Run this app named KissApp Official using MyAndroid.

You can do it using our Android online emulator.

A special application for kopkariss members that was officially released.

This application will continue to be developed in order to provide security, convenience and flexibility to kopkariss members.

Kopkar ISS Savings and Loans (KISSPin)

Is a form of providing money by Kopkar ISS to members based on an agreement that requires members as borrowers to repay within a certain period of time and pay for their services.

The following are several types of money loans available at Kopkar ISS, namely:

Macro Loans

Is a loan of large amounts of money given to members of the ISS Kopkar with terms and rules that have been mutually agreed upon.

Cost calculation:

o Nominal Loan Limit starting from: Rp.

2,500,000 Rp.

15,000,000

o Tenor duration ranging from: 90 Days (3 Months) 365 Days (12 Months)

o Interest Rate 12% (Twelve Percent) per year

o Administration fee Rp.

5,000 per month

Example:

If the Member chooses a loan limit of Rp.

5,000,000 with a period of 120 Days (6 Months).

- Total Principal Loan = Rp.

5,000,000

- Total Loan Interest = Rp.

5,000,000*1%*6 Months = Rp.300,000

- Total Administration = Rp.

5,000*6 Months = Rp.

30,000

- Total Loan Fee = Rp.

5,000,000 + Rp.

300,000 + Rp.

30,000 = Rp.

5,330,000

- Total Monthly Payment = Rp.

5,330,000 / 6 Months = Rp.

888.333

Macro Loan requirements include:

o Fill out the Macro Loan Application Form

o Attach a photocopy of the borrower's ID card

o Attach a copy of the ID card of the borrower's husband / wife

o Attach a Copy of Employee ID Card

o Attach a Copy of Family Card

o Attach a Supervisor's Recommendation Letter (minimum Manager level)

The process of disbursing a Macro Loan goes through a maximum waiting time of 2 (two) months, from the loan application requirements that have been completed and accepted by the ISS Kopkar team.

Micro Loans

It is a small amount of money that is given to members of the ISS Kopkar with terms and rules that have been mutually agreed upon.

Cost calculation:

o Loan nominal starting from: Rp.

500,000 Rp.

2,000,000

o Tenor duration starting from: 30 Days (1 Month) 90 Days (3 Months)

o Interest Rate 1% (One Percent) per month

Example:

If the Member chooses a loan limit of Rp.

1,000,000 with a period of 90 Days (3 Months).

- Total Principal Loan = Rp.

1,000,000

- Total Loan Interest = Rp.

1,000,000*1%*3 Months = Rp.30,000

- Total Loan Fee = Rp.

1.000.000 + Rp.

30,000 = Rp.

1.030.000

- Total Monthly Payment = Rp.

1.030.000 / 3 Months = Rp.

343.333

Micro Loan Requirements include;

o Fill in the Power of Attorney for Salary Deduction which has been signed physically or digitally using the PrivyId application.

This application will continue to be developed in order to provide security, convenience and flexibility to kopkariss members.

Kopkar ISS Savings and Loans (KISSPin)

Is a form of providing money by Kopkar ISS to members based on an agreement that requires members as borrowers to repay within a certain period of time and pay for their services.

The following are several types of money loans available at Kopkar ISS, namely:

Macro Loans

Is a loan of large amounts of money given to members of the ISS Kopkar with terms and rules that have been mutually agreed upon.

Cost calculation:

o Nominal Loan Limit starting from: Rp.

2,500,000 Rp.

15,000,000

o Tenor duration ranging from: 90 Days (3 Months) 365 Days (12 Months)

o Interest Rate 12% (Twelve Percent) per year

o Administration fee Rp.

5,000 per month

Example:

If the Member chooses a loan limit of Rp.

5,000,000 with a period of 120 Days (6 Months).

- Total Principal Loan = Rp.

5,000,000

- Total Loan Interest = Rp.

5,000,000*1%*6 Months = Rp.300,000

- Total Administration = Rp.

5,000*6 Months = Rp.

30,000

- Total Loan Fee = Rp.

5,000,000 + Rp.

300,000 + Rp.

30,000 = Rp.

5,330,000

- Total Monthly Payment = Rp.

5,330,000 / 6 Months = Rp.

888.333

Macro Loan requirements include:

o Fill out the Macro Loan Application Form

o Attach a photocopy of the borrower's ID card

o Attach a copy of the ID card of the borrower's husband / wife

o Attach a Copy of Employee ID Card

o Attach a Copy of Family Card

o Attach a Supervisor's Recommendation Letter (minimum Manager level)

The process of disbursing a Macro Loan goes through a maximum waiting time of 2 (two) months, from the loan application requirements that have been completed and accepted by the ISS Kopkar team.

Micro Loans

It is a small amount of money that is given to members of the ISS Kopkar with terms and rules that have been mutually agreed upon.

Cost calculation:

o Loan nominal starting from: Rp.

500,000 Rp.

2,000,000

o Tenor duration starting from: 30 Days (1 Month) 90 Days (3 Months)

o Interest Rate 1% (One Percent) per month

Example:

If the Member chooses a loan limit of Rp.

1,000,000 with a period of 90 Days (3 Months).

- Total Principal Loan = Rp.

1,000,000

- Total Loan Interest = Rp.

1,000,000*1%*3 Months = Rp.30,000

- Total Loan Fee = Rp.

1.000.000 + Rp.

30,000 = Rp.

1.030.000

- Total Monthly Payment = Rp.

1.030.000 / 3 Months = Rp.

343.333

Micro Loan Requirements include;

o Fill in the Power of Attorney for Salary Deduction which has been signed physically or digitally using the PrivyId application.

MyAndroid is not a downloader online for KissApp Official. It only allows to test online KissApp Official with apkid com.kissmobile. MyAndroid provides the official Google Play Store to run KissApp Official online.

©2025. MyAndroid. All Rights Reserved.

By OffiDocs Group OU – Registry code: 1609791 -VAT number: EE102345621.