We provide Real Estate Capital Gain online (apkid: apple.com.companynametb.capitalgainre) in order to run this application in our online Android emulator.

Description:

iPhone app Real Estate Capital Gain download it using MyAndroid.

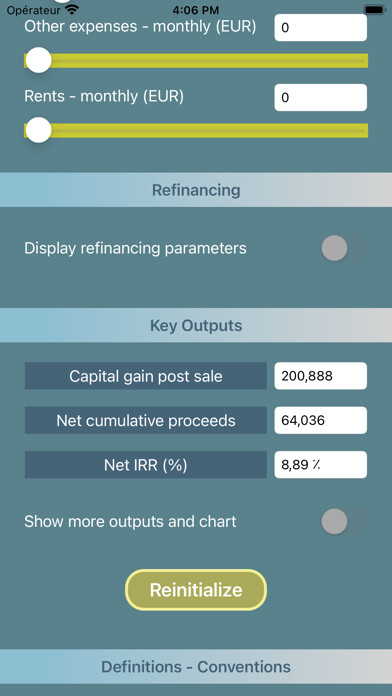

User-friendly application allowing to calculate the capital gain realized on the sale of a real estate investment, using leverage (debt quantum, interest rate, maturity) and by setting out some exit assumptions (year of sale, yearly RE market growth rate, initial purchase price of the investment).

The application displays also the value at sale of the property, the outstanding balance of debt at sale, the monthly debt service, total debt service paid to date and the sale price ratio in currency/m2.

All parameters can be set out by the user using sliders or by typing figures in text boxes.

Capital gain value is re-calculated dynamically while the user is setting out our updating parameters.

- New: specify the start year of rental of your property so that you can decouple it from the acquisition year and start rental phase later.

- New: directly send by email all inputs and outputs of your real estate simulation by clicking on the SEND button

- New: store in your mobile several simulations you have tested and consult them later even in case you exit from the application, through a recap table

- Gross capital gain post-sale = Sale proceeds - Outstanding Debt + Initial Debt Raised - Purchase Price

`- Net cumulative proceeds (including capital gain post sale) and Net IRR are ultimately assessed AFTER deduction of total debt service paid to date, AFTER eventual additional other expenses (other expenses budget is set out as a monthly budget so that to be able to define an all-in budget comprising customary additional expenses for real estate assets like for example: insurance, owners collective expenses, etc) and AFTER adding the eventual rents received from the property.` +- Net annual cash flows (as displayed in the chart): year 1: (-) purchase price (+) initial debt raised (-) debt service paid (-) other expenses paid (+) rents received | year 2 until refi (if any): (-) debt service paid (-) breaking costs for early repayment (-) other expenses paid (+) rents received | At refi year (if any): (+) refi debt amount raised (-) initial debt amount repaid (-) debt service paid (-) other expenses paid (+) rents received | beyond refi year (if any) until sale: (-) refi debt service paid (-) other expenses paid (+) rents received | at sale: (+) sale proceeds (-) outstanding (initial/refi) debt amount repaid (-) debt service paid (-) other expenses paid (+) rents received

- Net IRR (%) = IRR based upon all annual net cash flows (debt drawdown, purchase price, sale proceeds, debt balance repaid at sale, debt service flows, breaking costs for early repayment (in case of refi), other expenses, rents received

`- Introduction of the notion of other expenses set out as an additional monthly cost budget so that to allow user to define an all-in budget comprising additional expenses customary for real estate assets like for example: insurance, owners collective expenses, etc.` +- In case other expenses are set out by the user, the Net capital gain and Net IRR are calculated after deduction of the total budget paid for other expenses to date, at sale date.

- Introduction of the notion of rents set out as a monthly revenue amount and allow to calculate a Net IRR and Net Capital Gain that includes the eventual total rents received from inception until sale date

- Calculation conventions:

- No over-leverage: i) as part of initial debt case, quantum of debt raised cannot exceed initial purchase price of the property.

ii) as part of refinancing case, quantum of debt raised is equal to outstanding initial debt balance at refinancing date.

- interests are calculated upon begin of period debt balance for each period

- refinancing is assumed to occur begin of period and interests related to the year of refinancing are calculated upon the new refinancing debt interest rate

- at sale, outstanding debt balance is repaid at end of period, based upon end of period balance after annual debt service is paid,

MyAndroid is not a downloader online for Real Estate Capital Gain. It only allows to test online Real Estate Capital Gain with apkid apple.com.companynametb.capitalgainre. MyAndroid provides the official Google Play Store to run Real Estate Capital Gain online.

©2025. MyAndroid. All Rights Reserved.

By OffiDocs Group OU – Registry code: 1609791 -VAT number: EE102345621.